Analysis of Swiss Watch Exports (Jan-Sep 2021) in the Middle East by Arabian Watches & Jewellery

Swiss watch exports globally followed the trend of steady growth seen throughout Q3 of 2021, with 3.1% growth reported in September compared to September 2019 during pre-pandemic levels. Growth was mainly driven by the United States (63.2% increase in exports from Jan-Sep 2021 to 2020) and China (45.2% increase in exports from Jan-Sep 2021 to 2020) as the battle continues for the status of swiss watch export market leader.

The market share of Swiss watches priced below CHF 500 continues to decline with respect to value and number of items, as consumers are turning more and more towards premium products. This can be attributed to the fierce competition within the entry-level watch price segment, stimulated by the strong growth of smartwatches. However, Swiss watches priced above CHF 500 saw strong performance in September with an average increase of 2.2% in unit volume and 6.7% in market value relative to September 2019.

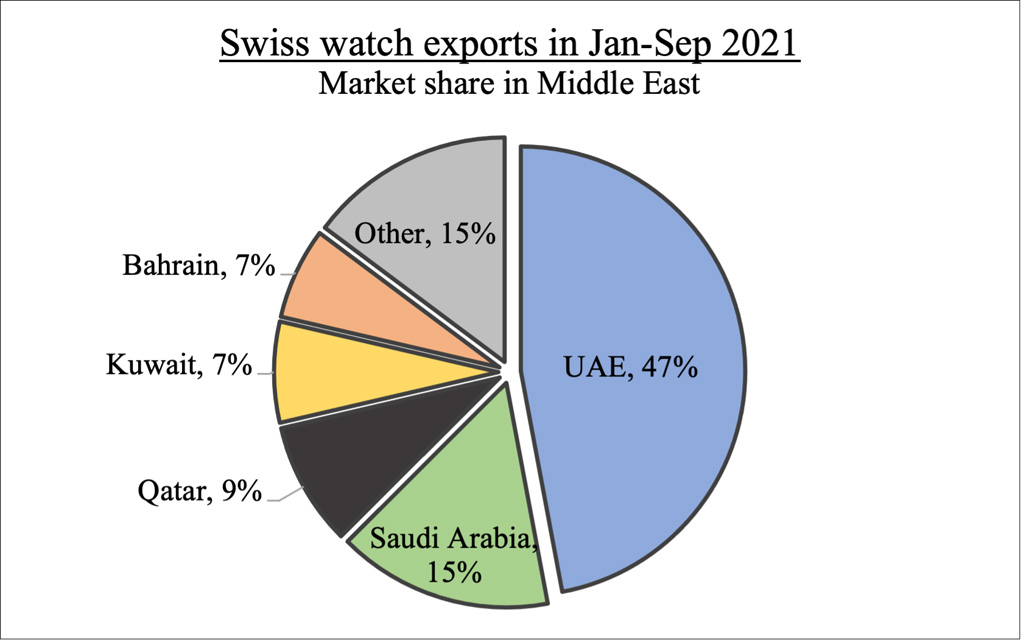

The distribution of the 9.1% market share of global Swiss watch exports held within the Middle East is illustrated above. The UAE is a clear market leader with 47% market share, followed by Saudi Arabia’s 15%. This is based on the value of exports and not end-consumer demand, as most regional Swiss watch offices are located in Dubai re-distributing these high-end luxury pieces across the Middle East.

The Middle East market for Swiss watches has shown resilience in recovering from the challenges facing the industry imposed by COVID-19, led by Saudi Arabia and Bahrain both with over 50% growth in Swiss watch export value from 2020 pandemic levels. Furthermore, Saudi Arabia and Bahrain are the only countries in the region to have exceeded 2019 pre-pandemic levels of export value by 1.9% and 5.4% respectively. The UAE and Kuwait trail closely behind with a contraction of Swiss watch export value of only 0.1% between the first three quarters of 2021 and pre-pandemic levels. |