fiogf49gjkf0d

Special Report By Arabian Watches & Jewellery Magazine.

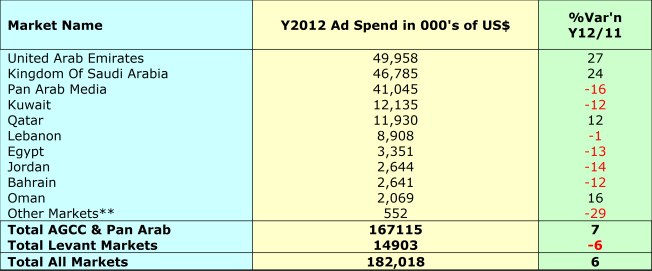

Jewellery and Watches sector monitored ad spending in the region reached US$ 182 million in Y 2012, translating a modest growth of 6% over Y 2011, despite hurdles like Arab Spring and global economic uncertainties.

The growth was strongly supported by key markets of UAE, Kingdom of Saudi Arabia and Qatar.

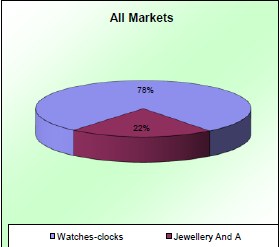

Advertising Spend per category (All Markets)

Watches accounts for 78% of the category share with US$ 143 million while Jewelry & accessories accounts the remaining 22% spending in the category. Watches category posted a flattened growth and clocked 3% uptick while Jewelry category shined with 18% gains.

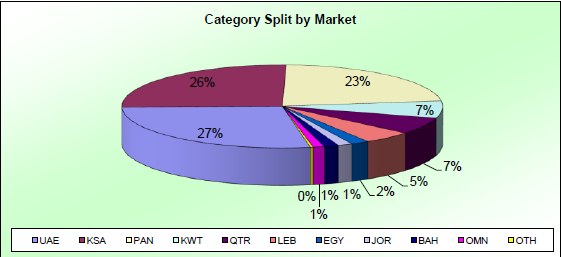

Advertising Spend by Top Five Markets

1) UAE has recorded the highest growth and is the top spending market in the sector with a total spends of around US$ 50 million. A robust growth of 27% was observed in the leading market.

2) Kingdom of Saudi Arabia spending surged by 24% and closely follows UAE to rank as next top spending market in the region in the sector.

3) Kuwait has managed to retain its third rank amongst top spending markets in the region despite a 12% plunge experienced.

4) Qatar spending showed a healthy double digit growth of 12%.

5) Other markets are reeling under the grip of cautious spending with the following variation:

Lebanon (-1%), Egypt (-13%), Jordan (-14%) and Bahrain (-12%).

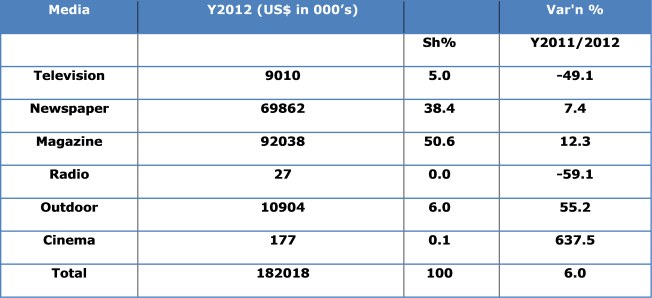

Advertising Spend - Media wise

A) Magazines

Amongst major monitored media types, advertisers in the sector are heavily skewed towards Magazines with the medium sharing more than half (51%) of the total ad spend on the sector in the region. Magazines further consolidated its spending by posting a robust 12% gains.

B) Newspapers

Newspaper shares 38% of the spending and its spending surged by 7%.

C) Television

Television with 5% share plummeted by 49%.

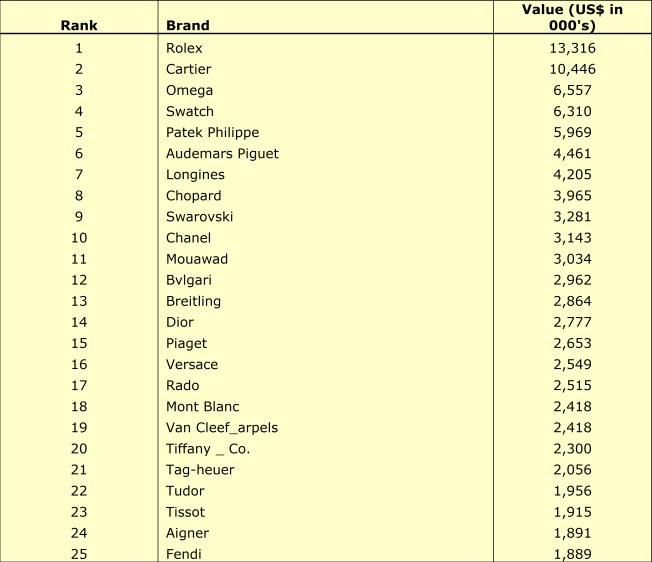

Top spending brands in the Middle East

The top spending brands in the sector in the region are Rolex, Cartier, Omega, Swatch Patek Philippe and Audemars Piguet by order of their measured spending.

Watch the space!!

Importantly, the top 25 brands by region and media, and the top 20 brands on television, newspapers, magazines and other top spenders will be some of the highlights to be presented in the second installment of this Market Report.

Note to readers:

Cautionary & Acknowledgment:

All accompanying published data, numerical input, tabulated charts, statistical information, pie charts, histograms & graphics have been analyzed and provided by Pan Arab Research Agency (PARC) & Advertising Monitoring Services.

Readers are advised to note that the figures provided reflect advertising expenditure based on published rates of the various media involved. Not accounted for are the discounts provided, special rates applicable, barter deals, other bilateral considerations nor the commissions accrued to advertising agencies. Whilst the discounts would factor in the arithmetic and computation, MPP-ME believes it will not significantly alter the overall perspective and emerging indicators of this very protracted and exhaustive PARC study.

As in previous years and with previous analyses, the MPP-ME, AWJ & www.mpp-me.com research team acknowledges with appreciation and gratitude the tremendous input, hard work and co-operation of the entire team at Pan Arab Research Centre, PARC, for access to all published data. Specifically, we would like to thank Sami Raffoul, General Manager, Mr. M Shaharyar Umar - Marketing Director and his dedicated team for their unstinted co-operation and support to this project.

Disclaimer: Spend is calculated in the published rate card and do not account for incentives or discounts that advertisers may avail from media owners.